Bridging the MSME Credit Gap in India

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in India’s economy, contributing significantly to employment generation and GDP growth. However, access to credit remains a persistent challenge for many MSMEs. To address this issue, the introduction of the One-Credit-Every-Enterprise Network (OCEN) platform has shown promising potential. This blog explores how OCEN can bridge the MSME credit gap in India and empower these businesses to thrive.

Understanding the MSME Credit Gap

MSMEs often face difficulty in accessing formal credit due to various reasons, including inadequate financial documentation, lack of collateral, and limited credit history. According to a survey by the Reserve Bank of India (RBI), the credit gap for MSMEs in India stands at a staggering $230 billion. This credit gap stifles the growth potential of MSMEs and hampers their ability to invest, expand, and create employment opportunities.

Introducing OCEN

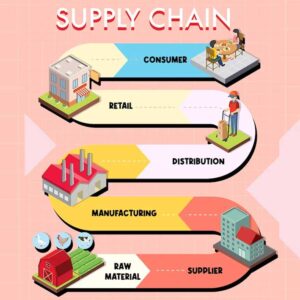

OCEN is an innovative platform designed to address the MSME credit gap by leveraging technology and data. It acts as a digital marketplace connecting lenders, borrowers, and other ecosystem participants such as credit bureaus, fintech companies, and government agencies. The platform enables lenders to access comprehensive credit information and assess the creditworthiness of MSMEs more effectively.

Data Integration and Accessibility

OCEN facilitates the integration of various data sources, including GST, tax returns, bank statements, and digital payments data. This rich pool of data provides lenders with a more holistic view of an MSME’s financial health and repayment capacity. By aggregating and analyzing this data, lenders can make informed credit decisions and extend financing to deserving MSMEs.

Improved Credit Assessment and Risk Mitigation

OCEN’s data-driven approach enhances the credit assessment process for MSMEs. Lenders can evaluate creditworthiness based on objective criteria, reducing dependency on traditional collateral-based assessments. The platform also helps in mitigating risks by offering insights into an MSME’s credit history, repayment behavior, and industry-specific performance indicators.

Expansion of Lender Base

OCEN enables traditional lenders, such as banks and non-banking financial companies (NBFCs), to extend credit to MSMEs more efficiently. It also encourages participation from new-age lenders, including fintech companies and peer-to-peer lending platforms. This expanded lender base provides MSMEs with a wider range of financing options and increases competition, potentially leading to more favorable loan terms.

Government Support and Incentives

The Indian government has recognized the importance of MSMEs and their contribution to the economy. As part of its initiatives, the government has introduced various measures to support OCEN’s implementation and encourage lender participation. These include interest rate subsidies, loan guarantees, and simplification of regulatory processes. Such support and incentives create a favorable ecosystem for MSMEs to access credit through OCEN.

Enhancing Financial Inclusion

OCEN has the potential to enhance financial inclusion by bringing informal and underserved MSMEs into the formal credit ecosystem. Through its data-driven approach, the platform can capture the creditworthiness of these entities, allowing them to access affordable and formal credit. This, in turn, empowers MSMEs to invest in technology, infrastructure, and skilled labor, driving their growth and economic impact.

Promoting Entrepreneurship and Job Creation

By addressing the MSME credit gap, OCEN can unleash the true potential of entrepreneurship in India. Increased access to credit enables MSMEs to expand operations, develop new products and services, and create job opportunities. This, in turn, contributes to economic growth, poverty reduction, and overall prosperity.

Takeaway

The MSME credit gap has long hindered the growth of small businesses in India. However, with the introduction of the OCEN platform, there is renewed hope for bridging this gap. By leveraging technology, data, and collaboration between stakeholders, OCEN has the potential to revolutionize MSME lending and empower businesses across the country. It is essential for policymakers, lenders, and MSMEs to embrace this innovative solution and work towards its widespread adoption.

References:

- Reserve Bank of India, “Survey on MSME Credit Gap,” (2019).

- Niti Aayog, “One-Credit-Every-Enterprise Network (OCEN): Towards a Financing Revolution for MSMEs” (2020).

- Confederation of Indian Industry (CII), “Accelerating Growth and Ease of Doing Business for MSMEs” (2019).

- The Economic Times, “OCEN can provide credit to the MSME sector on easier terms” (2021).

- Ministry of Micro, Small, and Medium Enterprises (MSME), Government of India, “MSME at a Glance” (2021).